Ⅰ.Analysis of Main Influencing Factors

1. Impact of carbon neutral policy

During the 75th UN General Assembly in 2020, China proposed that “carbon dioxide emissions should peak by 2030 and achieve carbon neutralization by 2060”.

At present, this goal has been formally entered into the administrative planning of the Chinese government, both in public meetings and local government policies.

According to China’s current production technology, carbon emissions control in the short term can only reduce steel production. Therefore, from the macro forecast, the future steel production will be reduced.

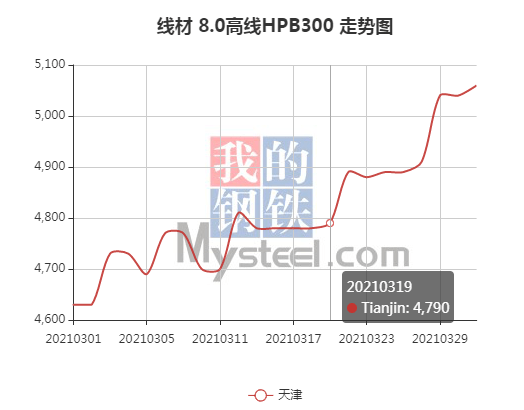

This trend has been reflected in the circular issued by the municipal government of Tangshan, China’s main steel producer, on March 19,2021, on reporting measures to limit production and reduce emissions of iron and steel enterprises.

The notice requires that, in addition to 3 standard enterprises ,14 of the remaining enterprises are limited to 50 production by July ,30 by December, and 16 by December.

After the official release of this document, steel prices rose sharply. (please check below picture)

Source: MySteel.com

2. Industry technology constraints

In order to achieve the goal of carbon neutralization, for the government, in addition to limiting the production of enterprises with large carbon emissions, it is necessary to improve the production technology of enterprises.

At present, the direction of cleaner production technology in China is as follows:

- Electric furnace steel instead of traditional furnace steelmaking.

- Hydrogen energy steelmaking replaces the traditional process.

The former cost increases by 10-30% due to the shortage of scrap raw materials, power resources and price constraints in China, while the latter needs to produce hydrogen through electrolytic water, which is also restricted by power resources, and the cost increases by 20-30%.

In the short term, steel production enterprises technology upgrading difficulties, can not quickly meet emission reduction requirements. So capacity in the short term, it is difficult to recover.

3. Inflation impact

By reading the China Monetary Policy Implementation Report issued by the Central Bank of China, we found that the new crown epidemic seriously affected the economic operation, although China gradually resumed production after the second quarter, but in the global economic downturn, in order to stimulate domestic consumption, the second, third and fourth quarters have adopted relatively loose monetary policy.

This directly leads to an increase in market liquidity, leading to higher prices.

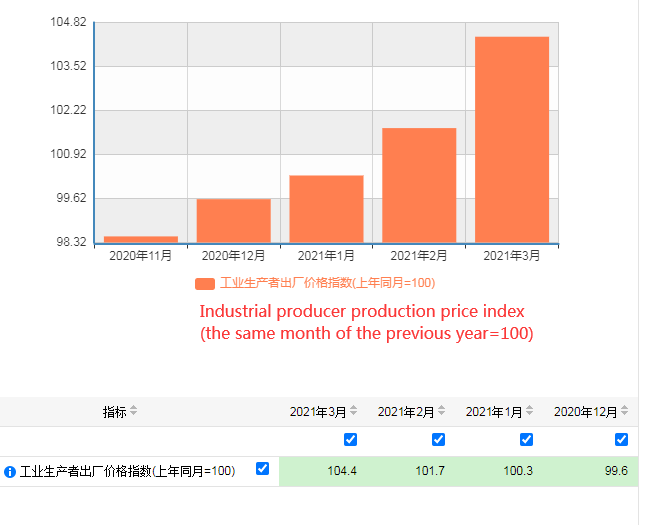

The PPI has been growing since last November, and the increase has gradually increased. (PPI is a measure of the trend and degree of change in ex-factory prices of industrial enterprises)

Source: National Bureau of Statistics of China

Ⅱ.Conclusion

Under the influence of policy, China’s steel market now presents an imbalance between supply and demand in the short term. Although only iron and steel production in Tangshan area is limited now, after entering the autumn and winter season in the second half of the year, iron and steel production enterprises in other parts of the north will also be regulated, which is likely to cause further impact on the market.

If we want to solve this problem from the root, we need steel enterprises to upgrade their technology. But according to the data, only a few large state-owned steel enterprises are carrying out new technology pilot. Thus, it can be predicted that this supply-demand imbalance will persist by the end of the year.

In the context of the epidemic, the world generally adopted loose monetary policy, China is no exception. Although, starting in 2021, the government adopted a more robust monetary policy to ease inflation, perhaps to some extent to cushion the rise in steel prices. However, under the influence of foreign inflation, the final effect is difficult to determine.

Regarding the steel price in the second half of the year, we think that it will fluctuate slightly and rise slowly.

Ⅲ.Reference

[1] Demand for being “tougher”! Carbon peaking and carbon neutrality drive high-quality development of the steel industry.

[2] This meeting planned the “14th Five-Year Plan” for carbon peaking and carbon neutrality work.

[3] Tangshan Iron and Steel: Annual production restrictions exceeded 50%, and prices hit a new 13-year high.

[4] People’s Bank of China. China’s Monetary Policy Execution Report for Q1-Q4 2020.

[5] Tangshan City Office of the Leading Group for Atmospheric Pollution Prevention and Control. Notice on Reporting Production Restriction and Emission Reduction Measures for Steel Industry Enterprises.

[6]WANG Guo-jun,ZHU Qing-de,WEI Guo-li.Cost Comparison Between EAF Steel and Converter Steel,2019[10]

Disclaimer:

The conclusion of the report is for reference only.